|

The

Budget’s 2011

ONE of the UK’s leading business

organisations are welcoming several short term measures to boost

enterprise announced in the Budget, but they are arguing that more

must be done in the long-term if small businesses are to truly drive

economic growth and job creation.

The Forum of Private Business believes substantial measures on fuel

duty – including an immediate cut and cancelling annual rises that

had resulted from the introduction of the fuel duty escalator;

should provide some cash flow relief for struggling small firms.

Equally, the Forum is welcoming a range of small business tax breaks

including lower rates for businesses based in 21 new

‘enterprise zones’, increasing tax relief available under

the Enterprise Investment Scheme and the decision to keep Community

Investment Tax Relief contrary to recommendations made by the Office

of Tax Simplification (OTS).

However, while the Forum also welcomes the Government’s continued

commitment to reducing corporation tax overall, it is disappointed

that small firms’ corporation tax bills are not being reduced by a

similar rate to the higher level paid by big businesses, which the

Chancellor is now slashing by 2% in April 2011 - double the

reduction that had been planned – and from 28% to 23% by April 2014.

The Forum believes a number of opportunities have been missed for

real root-and-branch tax simplification and radical reforms removing

small firms from tax wherever possible – incentivising small

businesses charged with leading economic recovery, rather than

pandering to large companies. In its submission to the 2011 Budget

the Forum called for the lower corporation tax rate to be cut to

17%.

In particular, the organisation is concerned that simply lowering

from £18 to £15 the threshold price of goods shipped via the Channel

Islands on which no VAT is payable will not stop large companies

exploiting Low Value Consignment Relief (LVCR).

The Forum agrees with the pressure group Retailers Against VAT Abuse

(RAVAS) that the real test is whether businesses that do not have

offshore facilities can now compete on an equal basis with their

counterparts on the Channel Islands. The answer for smaller

retailers – including those selling CDs and DVDs which will still

have to charge VAT – is clearly no.

It is important that the Government’s plans to work with the

European Commission to limit the scope of the relief so that it can

no longer be exploited for a purpose other than what it was not

intended for stops the LVCR trade once and for all.

The Forum also believes that merging Income Tax and National

Insurance (NI) into a single payroll tax is a step towards

simplifying the UK’s complex tax system, and welcomes the

announcement of a consultation into this, but is concerned that NI –

a tax on employment at a time small businesses are charged with

creating jobs - is still rising for most firms.

With the ability of small businesses to employ people under

scrutiny, and a raft of employment legislation covering issues such

as the default retirement age, pensions, parental leave and agency

workers on the horizon for 2011, the Government’s plans for red tape

have been keenly anticipated by business owners struggling to cope

with the annual £12 billion cost of compliance bill.

Providing it produces measures that actually reduce small firms’

administrative burden, a review of all existing business laws is

both welcome and long overdue - as is a specific review of health

and safety law with a commitment to scrapping all unnecessary health

and safety red tape.

In its capacity as Secretariat of the All Party group on

Micro-business, the Forum is also backing the Government’s

announcement that all firms with 10 employees and under – both start

ups and established businesses - are to be given a 3 year holiday on

incoming red tape.

However, the organisation is concerned that the moratorium will not

apply to red tape stemming from EU law – which creates the majority

of regulatory hurdles for small firms - and is also calling for

similar regulatory relief for larger SMEs that have also been

charged with creating the jobs set to be lost in the public sector.

The Forum is also welcoming the announcement of an additional 50,000

apprenticeships over the next 4 years, but believes more support is

required to help entrepreneurs create these apprenticeships within

their businesses, and proposed changes to make planning laws more

business friendly.

“It was important a Budget heralded as being pro-enterprise focused

on easing the dual burdens of tax and red tape – 2 of the biggest

barriers to business growth and job creation facing small

businesses. In that sense, we weren’t disappointed and this was

certainly more than just a nod in the direction of UK SMEs. However,

while there have been some definite steps in the right direction the

Government could have gone further in reducing taxes and making the

tax and regulatory systems more proportional to all small businesses

so that they incentivise to entrepreneurship rather than act as a

barrier to it. In summary, there are some good short-term measures

here, but more radical changes are required over the longer term.

The lessons of history show that you achieve rapid, widespread small

business growth – and therefore economic growth - by removing

entrepreneurs from the stranglehold of tax and red tape as much as

is practically possible. While they will broadly welcome many of the

Chancellors’ announcements, British business owners will be looking

for much more in the way of real actions in the weeks, months and

years that lie ahead.” said the Forum’s Chief Executive,

Phil Orford.

The Forum’s Budget submission was based on its new Get Britain

Tradingcampaign, which aims to raise awareness of the significant

contribution played by small businesses in the UK’s economy and

create trading conditions conducive to success.

John McDonnell MP, Parliamentary Convenor of the TUCG, which

represents 10 national trade unions, said:- "This is a Budget

for big business which ignores rising unemployment & refuses to halt

the cuts in public services. We are sleepwalking into a deflationary

spiral which will see real hardship for the most vulnerable in our

communities. Osborne is cutting taxes for big business to their

lowest level for forty years at the same time as implimenting savage

cuts that will cut public services to the bone and bring into

question the future of the Welfare State. To pretend that,

"we are all in this together", is a

very bad joke. Ongoing Government attacks on Pensions, Health and

Safety, Pay and Employment Rights are not an acceptable price to pay

for the profligacy of the banks."

The UK’s largest union, UNISON is calling for a change of direction

and a budget for growth including a Robin Hood Tax. This tax on the

banks would add £20 billion to the public purse; 20 times the

measures that the Chancellor has announced to close tax loopholes.

Twenty billion would save local services from shut down, keep

children’s nurseries open, stop hospital’s shedding jobs and save

adult day centres from closure.

UNISON's General Secretary, Dave Prentis, who said:- “Under

the Tories our economy isn’t growing, but the dole queues are. The

Government’s own Office of Budget Responsibility has downgraded the

growth forecast by 0.9% since the Chancellor’s last budget. The

carnage going on in the public sector was completely written out of

the Chancellor’s budget. Osborne should have used this budget to

right his economic wrongs. This no budge budget flies in the face of

mounting evidence of the toll Tory cuts are taking on our economy

and our society. The Chancellor is pinning his hopes on the private

sector driving the recovery – but the evidence shows the private

sector is not creating enough jobs to stop total unemployment from

rising. Struggling families will be pleased that tax receipts have

been used to stop fuel price rises. But with dole queues rising, and

business and consumer confidence low, this is a warning to Osborne –

he will not be able to rely on tax receipts to top up spending much

longer. Osborne's over-hyped increase in tax allowances will in fact

be worth less than £2.50 a week to the average basic rate taxpayer.

This is more than cancelled out by the increase in VAT, which will

cost the average family more than £3 a week, and other reductions in

benefits, tax credits and services, which will cost families even

more. This small tax giveaway will do nothing to help the 2.53

million people on the dole and struggling to find work. It is a drop

in the ocean for millions of public sector workers hit by pay

freezes. With inflation up to 5.5%, any benefit will swiftly be

wiped out by higher prices. The Learjet levy is a token gesture. The

mega-rich who can afford a private plane could pay a lot more

towards our recovery. Instead, public sector workers are cutting

back on food, vital healthcare such as dentists and prescriptions,

and are still racking up high levels of personal debt. The poor,

sick and vulnerable who did not gamble away our future are paying

the price, as the public services they rely on disappear.”

Do you agree with these people? Let us know by

emailing our newsroom. |

New

Communities given welcome...

LIVEROPOOL John Lennon Airport (JLA)

along with the Airport Operators Association (AOA) – the trade

association that represents UK airports, has welcomed the fact that

the Chancellor has listened to submissions made by JLA and other AOA

members and decided not to increase Air Passenger Duty (APD) for

this year.

However Management at the Airport are warning that passengers still

face the prospect of ‘double taxation’ and further

increases in flying taxes when aviation enters the EU Emissions

Trading Scheme in 2012; and also that the Chancellor may raise APD

next year (2012).

APD in the UK is already up to 8.5 times more than the European

average. Many European countries have either already abandoned their

aviation taxes, or indicated that they will do so, due to the

negative effects on their economies including:- Belgium, Denmark,

Germany, Holland, Ireland and Malta.

Even with the freeze, the UK economy is already losing £750m in GDP

and 18,000 jobs as a direct result of the recent November 2010 rises

in APD, not to mention the thousands of UK tourism jobs lost because

less people can afford to holiday here. Scotland alone is estimated

to be losing over 1.2m passengers, 148,000 tourists and £77m in

revenue in the next 3 years.

Craig Richmond, CEO of Peel Airports commented:- “We are

pleased that the Government has listened to our concerns, however

this is only the beginning and we urge anyone who travels by air,

both on business or leisure, to continue to lobby Government

further. Unlike the vast majority of European nations who

experienced air passenger growth in 2010, the UK saw a decline. A

‘double taxation’ in 2012 will simply deter even more passengers

from flying to and from the UK in future.”

Darren Caplan, Chief Executive of the Airport Operators Association,

said:- “UK airports cautiously welcome the fact that Air

Passenger Duty is not going up immediately, though would not support

the delayed increase coming into effect next year. We now call on

the Chancellor to emulate the decisions of European competitor

nations to reduce or abolish APD in the UK. Additionally, many

people aren’t aware that UK aviation is also joining the EU

Emissions Trading Scheme (ETS) in 2012. This means that as things

stand passengers will be subject to the costs of both ETS as well as

aviation tax, so that holidaymakers and business travellers will

effectively be paying double taxation next year. The Chancellor now

needs to set out the government’s approach on reducing taxes on

flying when the ETS comes in, otherwise passengers will simply be

facing an actual tax increase later on in this 2011-12 financial

year. There should be no double taxation of British aviation.”

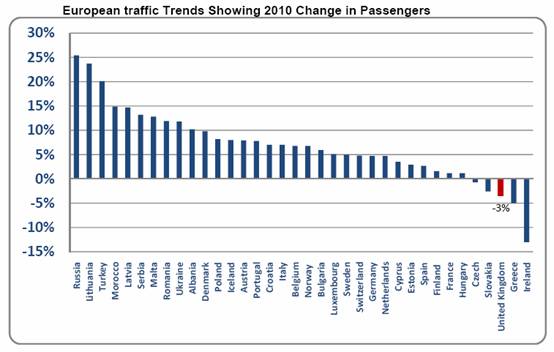

UK air passengers fell by 3% in 2010, with the decline far worse

than the majority of other European countries.

The Actors’ Studio,

Seal Street, Liverpool

AFTER a fantastic inaugural year

Write Now, Liverpool’s newest premier one act play festival, is

back! As well as e8 world premiere plays, Write Now, has

exciting new events including Monologue Slam, a chance to showcase

new acting talent in front of industry professionals and Ten Tall

Tower Tales, set in an apartment block it tells 10 stories from 10

storeys, each five minutes long. Write Now also has a fantastic

writing forum event supported by The Liverpool Everyman Playhouse

Literary Department which is free of charge.

Festival Director Ian Moore adds:- “Write Now 2010 highlighted

the need for a platform such as this. New writing, offering

performers, directors and technicians the chance to showcase their

talent is an absolute must for an ever developing arts industry.”

Write Now’s ethos of new writing and supporting talent has seen it

achieve a great deal of support from acclaimed figures such as

Pauline Daniels and BBC correspondent Roger Phillips.

Patron Pauline Daniels admits:- "New writing is the lifeblood

of the industry. It's great that writers will get the chance to

showcase their work as there are fewer and fewer opportunities to

take risks and discover fresh talent."

"Pieces include Warrington based Natalie Hickman’s comedy Monkey

Nuts and, particularly for the family audience, Jersey based,

Liverpool born playwright Neil Walden returns to the city with

Striker, a comedy adventure for everyone aged 4 and above.

Liverpool playwrights are also well represented with 3 pieces:- The

Place Where We Stand, Spion Kop, Mrs Bojangles and Excess Baggage,

which are all premiering. We’ve got something for everyone. Comedy,

drama, farce, historical pieces and something for the kids in a

great season of new writing.” added Ian.

For more information why not visit:-

writenowfestival.co.uk.

JLA urges the

Chancellor to rule out ‘double taxation’ on flying in 2012

LIVEROPOOL John Lennon Airport (JLA)

along with the Airport Operators Association (AOA) – the trade

association that represents UK airports, today welcomed the fact

that the Chancellor has listened to submissions made by JLA and

other AOA members and decided not to increase Air Passenger Duty (APD)

for this year (2011).

However Management at the Airport are warning that passengers still

face the prospect of ‘double taxation’ and further

increases in flying taxes when aviation enters the EU Emissions

Trading Scheme in 2012; and also that the Chancellor may raise APD

next year.

APD in the UK is already up to 8.5 times more than the European

average. Many European countries have either already abandoned their

aviation taxes, or indicated that they will do so, due to the

negative effects on their economies including: Belgium, Denmark,

Germany, Holland, Ireland and Malta.

Even with the freeze, the UK economy is already losing £750m in GDP

and 18,000 jobs as a direct result of the recent November 2010 rises

in APD, not to mention the thousands of UK tourism jobs lost because

less people can afford to holiday here. Scotland alone is estimated

to be losing over 1.2m passengers, 148,000 tourists and £77m in

revenue in the next 3 years.

Craig Richmond, CEO of Peel Airports commented:- “We are

pleased that the Government has listened to our concerns, however

this is only the beginning and we urge anyone who travels by air,

both on business or leisure, to continue to lobby Government

further. Unlike the vast majority of European nations who

experienced air passenger growth in 2010, the UK saw a decline. A

‘double taxation’ in 2012 will simply deter even more passengers

from flying to and from the UK in future.”

Darren Caplan, Chief Executive of the Airport Operators Association,

said:- “UK airports cautiously welcome the fact that Air

Passenger Duty is not going up immediately, though would not support

the delayed increase coming into effect next year. We now call on

the Chancellor to emulate the decisions of European competitor

nations to reduce or abolish APD in the UK. Additionally, many

people aren’t aware that UK aviation is also joining the EU

Emissions Trading Scheme (ETS) in 2012. This means that as things

stand passengers will be subject to the costs of both ETS as well as

aviation tax, so that holidaymakers and business travellers will

effectively be paying double taxation next year. The Chancellor now

needs to set out the government’s approach on reducing taxes on

flying when the ETS comes in, otherwise passengers will simply be

facing an actual tax increase later on in this 2011 to 2012

financial year. There should be no double taxation of British

aviation." |