|

HM Revenue & Customs Letters

THE HM Revenue

& Customs this year have been putting out large stories in local and

national media about clamping down on "self-employed tax

credit cheats" so it is not surprising that people are under

review. Sadly, HMRC is not communicating within its departments

because of rules laid down by the previous government, and this has

caused a lot of problems. In the last few weeks many self-employed

people have been receiving letters asking for information about

themselves. These letters are said to have been sent out at random

to people who are self-employed, but the system has not been stopped

from targeting people who have had recent problems or are still

having problems with HMRC. This lack of communication has thus added

extra strain on people who are already in a vulnerable situation

which has often been very alarming for them. The questions, in the

letters sent out, are very direct and extremely invasive in what

they request and the tone of the letter makes it sound as if the

recipient is undergoing a Formal Investigation by HMRC, because the

format is a generic letter which is aimed to cover all sections of

self-employment. Many self-employed people work extremely long hours

and get little in return, due to the current climate, so Tax Credits

have been recommended by the Tax Offices as an option to help them

out. Unfortunately, this has turned into a long running disaster for

some, yet for others it has been the makings of them. For those who

are suffering bad experiences, receiving one of these letters can be

very shocking. Many people don’t ponder the number of hours they

work, as they are employed and have hour sheets For self-employed

people however, it is not always as easy to provided evidence of

hours worked when asked. This is not normally an issue, but for

those claiming tax credits, it can be. Working Tax Credits are only

awarded to people if they or their partner are working enough hours

a week and their income is low enough. Also, you don't need to have

children to qualify and on the face of it doesn't matter whether you

are working as an employee or are self-employed. And this is

precisely where the problem gets a bit more complicated. The number

of hours you have to do to qualify for Credit depends on your

circumstances. There are various ways that someone on low income,

can qualify to receive Working Tax Credits. People who are 16 or

over and work 16 hours or more a week, can get Working Tax Credit.

They can also receive it if responsible for a child or young person.

Also support may be obtained if you are 16 or over and work 16 hours

or more a week, you are disabled and you receive a qualifying

benefit. It is also open to you if you are 50 or over and you work

16 hours or more a week, as long as you were getting certain

benefits for at least 6 months before you started work. Plus, on top

of that, if you are 25 or over and you work 30 hours or more a week

you may get Working Tax Credits, if your pay is low enough. In this

situation you do not have to have a child in order to claim either.

Lastly, if you work 16 hours or more a week and are aged 60 or over,

you can apply, if your pay is low enough to qualify. So it sounds

simple and on the face of it, it is! For some areas of

self-employment a problem has been lurking for many years now. The

question is, how do you prove the amount of hours you work? Some

sections of self-employment are clear cut and have no big issues,

like hair dressers, who do set appointments and can supply

information at request, proving the hours they work; others might

have problems doing this. One group affected by this are freelance

photographers. If they have studios it can be very easy to show, but

for others it is a very different matter, especially for

journalists. The appointment books sometimes do not show what the

hours are in reality. Same goes for leaflet droppers and even some

sales people, who do cold calling. As we started to look into this

we are shocked at how many people do not keep long term records of

the hours they work, when freelance (self-employed). It is not

necessarily something you automatically register, as you do with say

financial records. So this comes as a massive shock to be asked for

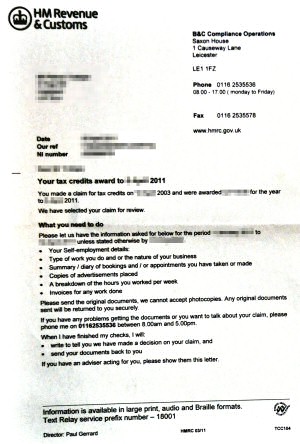

information. The letters read:- “Please let us have the

information asked for below for the period 1 January 2011 ******

unless stated otherwise by ** May 2011. Your self-employment

details. Type of work you do and or nature of your business. Your

unique Taxpayer Reference Number. Summary / diary of bookings and/or

appointments you have taken or made. Copies of advertisements

placed. A breakdown of the hours you worked per week. Invoices for

any work done. Statements from all your bank and building society

accounts (including any joint accounts). Please send the original

documents, we cannot accept photocopies. Any original documents sent

will be returned to you securely.” The letters sent out give

very little time to react to them and they do have a phone number on

for help. But before we go on to that issue, another worry is how

intrusive the request is, as many self-employed use personal diaries

to keep business information in, and add to that even more use

mobile phones and other electronic equipment to keep the

appointments on. That is not just a small selection, but a massive

cross section. The problems with many mobiles and other electronic

systems are that you cannot print the appointments off and there are

therefore no original paper documents! It does say:- “Summary”,

but that is contradicted with it stating:- “original

documents”. Also, they request you send them by recorded

delivery, and that you will not get reimbursed for the sending of

them. This raises an issue, as many on tax credits can ill afford

such added expenses and what happens if they can’t print off the

information? If you are a reporter as with some other jobs, sending

out confidential information can be even more of an issue. Compound

this with the fact that some occupations, tasks and appointments

flow from one to another, so are difficult to record individually.

HMRC demand original copies of your bank records, invoices, bills,

etc. All this adds up in weight for postage, and time to put all

together. And time is usually of the essence for the small

businesses struggling to keep afloat. No wonder many consider it

easier to give up and become unemployed! Ok, on the face of it, this

sounds like an easy task, but think about it for a second.

...Continued... THE HM Revenue

& Customs this year have been putting out large stories in local and

national media about clamping down on "self-employed tax

credit cheats" so it is not surprising that people are under

review. Sadly, HMRC is not communicating within its departments

because of rules laid down by the previous government, and this has

caused a lot of problems. In the last few weeks many self-employed

people have been receiving letters asking for information about

themselves. These letters are said to have been sent out at random

to people who are self-employed, but the system has not been stopped

from targeting people who have had recent problems or are still

having problems with HMRC. This lack of communication has thus added

extra strain on people who are already in a vulnerable situation

which has often been very alarming for them. The questions, in the

letters sent out, are very direct and extremely invasive in what

they request and the tone of the letter makes it sound as if the

recipient is undergoing a Formal Investigation by HMRC, because the

format is a generic letter which is aimed to cover all sections of

self-employment. Many self-employed people work extremely long hours

and get little in return, due to the current climate, so Tax Credits

have been recommended by the Tax Offices as an option to help them

out. Unfortunately, this has turned into a long running disaster for

some, yet for others it has been the makings of them. For those who

are suffering bad experiences, receiving one of these letters can be

very shocking. Many people don’t ponder the number of hours they

work, as they are employed and have hour sheets For self-employed

people however, it is not always as easy to provided evidence of

hours worked when asked. This is not normally an issue, but for

those claiming tax credits, it can be. Working Tax Credits are only

awarded to people if they or their partner are working enough hours

a week and their income is low enough. Also, you don't need to have

children to qualify and on the face of it doesn't matter whether you

are working as an employee or are self-employed. And this is

precisely where the problem gets a bit more complicated. The number

of hours you have to do to qualify for Credit depends on your

circumstances. There are various ways that someone on low income,

can qualify to receive Working Tax Credits. People who are 16 or

over and work 16 hours or more a week, can get Working Tax Credit.

They can also receive it if responsible for a child or young person.

Also support may be obtained if you are 16 or over and work 16 hours

or more a week, you are disabled and you receive a qualifying

benefit. It is also open to you if you are 50 or over and you work

16 hours or more a week, as long as you were getting certain

benefits for at least 6 months before you started work. Plus, on top

of that, if you are 25 or over and you work 30 hours or more a week

you may get Working Tax Credits, if your pay is low enough. In this

situation you do not have to have a child in order to claim either.

Lastly, if you work 16 hours or more a week and are aged 60 or over,

you can apply, if your pay is low enough to qualify. So it sounds

simple and on the face of it, it is! For some areas of

self-employment a problem has been lurking for many years now. The

question is, how do you prove the amount of hours you work? Some

sections of self-employment are clear cut and have no big issues,

like hair dressers, who do set appointments and can supply

information at request, proving the hours they work; others might

have problems doing this. One group affected by this are freelance

photographers. If they have studios it can be very easy to show, but

for others it is a very different matter, especially for

journalists. The appointment books sometimes do not show what the

hours are in reality. Same goes for leaflet droppers and even some

sales people, who do cold calling. As we started to look into this

we are shocked at how many people do not keep long term records of

the hours they work, when freelance (self-employed). It is not

necessarily something you automatically register, as you do with say

financial records. So this comes as a massive shock to be asked for

information. The letters read:- “Please let us have the

information asked for below for the period 1 January 2011 ******

unless stated otherwise by ** May 2011. Your self-employment

details. Type of work you do and or nature of your business. Your

unique Taxpayer Reference Number. Summary / diary of bookings and/or

appointments you have taken or made. Copies of advertisements

placed. A breakdown of the hours you worked per week. Invoices for

any work done. Statements from all your bank and building society

accounts (including any joint accounts). Please send the original

documents, we cannot accept photocopies. Any original documents sent

will be returned to you securely.” The letters sent out give

very little time to react to them and they do have a phone number on

for help. But before we go on to that issue, another worry is how

intrusive the request is, as many self-employed use personal diaries

to keep business information in, and add to that even more use

mobile phones and other electronic equipment to keep the

appointments on. That is not just a small selection, but a massive

cross section. The problems with many mobiles and other electronic

systems are that you cannot print the appointments off and there are

therefore no original paper documents! It does say:- “Summary”,

but that is contradicted with it stating:- “original

documents”. Also, they request you send them by recorded

delivery, and that you will not get reimbursed for the sending of

them. This raises an issue, as many on tax credits can ill afford

such added expenses and what happens if they can’t print off the

information? If you are a reporter as with some other jobs, sending

out confidential information can be even more of an issue. Compound

this with the fact that some occupations, tasks and appointments

flow from one to another, so are difficult to record individually.

HMRC demand original copies of your bank records, invoices, bills,

etc. All this adds up in weight for postage, and time to put all

together. And time is usually of the essence for the small

businesses struggling to keep afloat. No wonder many consider it

easier to give up and become unemployed! Ok, on the face of it, this

sounds like an easy task, but think about it for a second.

...Continued... |

|

..Continued...

All this detailed information it

is not what you get asked for when supplying your tax returns and

they have the financial information all ready. Also printing out

online banking forms is not allowed in most cases as they require

originals, so added expense is required to get extra copies from the

bank, just in case they are lost! Again this extra work means

additional cost that someone asking for help can ill afford.

Compound this with the fact that there has been a surfeit of bank

holidays, so many are struggling to get back on track. Letters have

been delivered late as a result, the banks have been closed which

all adds to the stress of trying to meet very short deadlines

imposed by the HMRC. Much of this could be easily rectified if the

department conducting the reviews could talk to the other

departments. And the diary problem would become less of an issue.

The reason, we have been told, that they are asking for this is that

they are trying to build up a picture of cross sections of

self-employed people so they can check all receiving the credits are

doing so fairly and are working the correct number of hours. That on

the face of it is very understandable, yet the tone of the letter,

the shortness of time requested for the recipient to respond is, for

some, beyond a joke. When they tried to phone for advice or help,

shock. The number did not work! One of the readers who contacted us

about it said:- “I have received the tax credits questionnaire

wanting to know information about me. I was pushed into self

employment by Jobcentre plus and Inbiz under the government’s New

Deal 50 plus, the training for doing my accounts was an excel spread

sheet, supplied by the Inbiz advisor, and then instructions to enter

each months’ receipts and work invoices into the spread sheet and

then to put those receipts into an envelope marked with the month on

it and file them. There was no mention of keeping hour by hour, day

by day records? I am absolutely stressed out by what is

happening and feel ill with worry. I have been unwell due to

stress and unemployment benefit pays more than I get now and

sickness benefit even more, I don't wish to go there, I want to keep

plugging away at trying to make my business a success. This is added

pressure I can ill afford. There was a number to contact if I had

any queries, I have dialled it on that number, but got an

unobtainable/disconnected tone. Thinking it was a Phishing Scam

letter, I contacted Tax Credits directly who informed me that the

compliance officer was not logged into the system so the number,

which is individual, will not work. The tax credits adviser said

they would email the officer to let her know that I wished to speak

with them. Later in the day they rang me back and told me they had

received an email reply and that I should ring the following day. I

rang a number of times the next day, on the number supplied on the

letter, only to be met by the same unobtainable tone? This only adds

to my stress as I want advice as the deadline is only days off and I

have only just had the letter.” Others phoned and were told

that “The office must be on holiday this week.” and

other excuses had been given to those with questions. We also tried

to get in contact and our editor experienced the same problem. After

contacting the HM Revenue & Customs press office in London, we

eventually received a call from a very helpful officer, who

explained that they had sent the letter out randomly and reassured

us that the letters are not at this stage targeted. Sadly, they were

unaware of other issues as they cannot communicate internally due to

‘Data Protection’ and as the letter was generic, they

expected many calls for help. HM Revenue & Customs said in an

official press statement to us that:- “We have had problems

with the phone numbers at one of our offices in Leicester. Since

becoming aware with this problem, we have tried to contact all our

customers who received a letter quoting this phone number, to offer

an alternative number. We apologise for the inconvenience and

possible concern this may have caused any of our customers.”

Unhappily for the staff on the Leicester number, the lack of

communication from other departments to clients has resulted in many

already worried clients getting even more anxious and stressed. This

will only cause more problems for the HMRC staff who, when we got

though, were very sorry about and embarrassed by the fault, and were

extremely informative and helpful. Also with phishing on the

increases, the fear is that many might have binned the letter and

will ignore it? Our advice is if you did, or do receive such a

letter, get in contact as soon as possible with who the Tax Credits

Office who will help and advice you further. Also you can contact

your Citizens Advice Bureau for more information and support, should

you require help.

For advice about Tax

Credits you can go to the 2 following links:-

HMRC 1 |

HMRC 2

The review of the

system for Tax Credits has good intentions, and here at Southport

Reporter, we agree to the ideas behind it. We also acknowledge that

this is an unusual problem which has affected them, with the added

problems of Easter, Bank Holidays and the phone line going down, but

we do feel strongly that more communication within Inland Revenue

might be advisable, for not only the sake of those ringing them up,

but also for their own staff. We felt very sorry for the staff in

Leicester who, no doubt, will be put under an unfair light as a

result of this failure in communication, through no fault of their

own, once we found out the true intent of the letters and the nature

of the fault. Also the tone of the letters being sent out and the

way they are sent out should, in our view, be looked into, and not

just these letters, but many others sent out daily by HMRC. This, in

our view could ease tensions and stress for all concerned, and could

easily save lots of added costs on all sides as a result. We will be

keeping an eye on this situation and passing any extra information

on to Southport’s MP John Pugh. If you want to contact our news room

please email us via

news24@southportreporter.com and if

you do not want to be quoted or identified, but just want us to know

you have a problem, please state this clearly. Also if you want us

to forward it to the Southport MP’s office, please state that

clearly as well. We would like to thank both the London HMRC Tax

Office and Leicester for helping us to ease the worries of quite a

few of our readers.

Our related archived new reports:-

1,

2,

3. |